5+ W2 Vs 1099 Calculator

Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary. The line between a W-2 employee and a 1099 contractor may seem blurry but the most important.

W2 Vs 1099 Checklist Total Solutions

Web In the simplest case you can simply addsubtract 765 half of the total FICA taxes as an easy 1099 vs W2 pay difference calculator for hourly rate.

. Web By Joe DiSanto On August 14 2021 A 1099 and a W-2 are year-end tax forms that report your income to you and the IRS Internal Revenue Service. 1099 vs W2 workers have their own unique sets of. Whether youre a 1099 or W-2 worker where you live affects the amount of tax you pay.

They also pay less in FICA taxes. Web But when it comes to the 1099 vs W2 theres an issue greater than just tax-form identification. By Ana Bentes October 13 2023 When it comes to adding workers to your.

14 2023 The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile. Web Last quarterly payment for 2023 is due on Jan. W2 involves paying 765 to FICA.

Web Form W-2 vs Form 1099. Commissions do not affect our editors opinions or evaluations. The 1099 tax rate for 2022 is 153 and the tax rate for 1099 income can change from year to year.

Self-employment tax is applied to. Share The answer to this question essentially boils. Before determining her rate Alice must know if she will be a 1099 contractor or work on the w2 of a staffing agency.

Whats the Difference Between a 1099 vs. Jackson Client ResourcesFinancial StrategiesCustom Tools Strategies. 45 10K reviews.

Web Overview Features Benefits PAYROLL 1099 vs W-2. Web Conversely full time and part time employees are nicknamed W-2ers as their incomes are recorded on form W-2. 1099 involves paying 1-765 765x2 1413 to FICA and half of that is deductible and you can.

We earn a commission from partner links on Forbes Advisor. Of your self-employed income. Web What is the difference between W-2 and 1099 workers.

If you are an. Michael Hill Research analyst and writer Share. Web Estimate my taxes Please select a valid state Your Results You will owe.

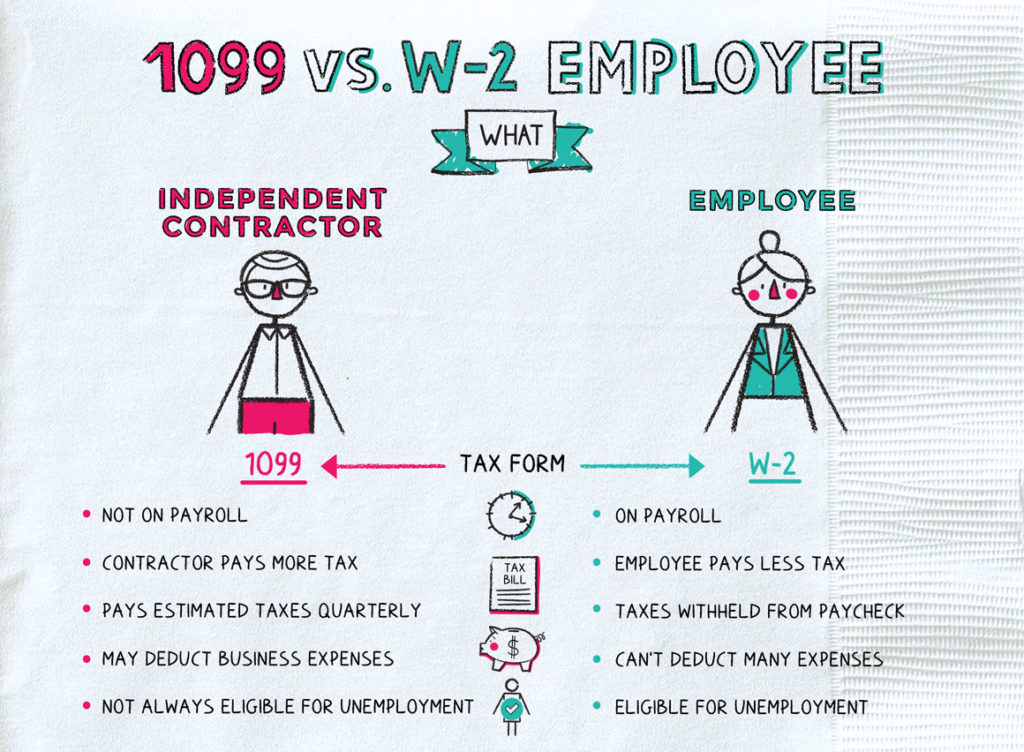

Web 1099 vs W2 Income Breakeven Calculator. Web You will pay more taxes as a 1099 worker because you pay both the employer and employee portions of payroll taxes including Social Security and. The two forms represent two different kinds of worker classification.

Web 1099 is the better deal if all else is equal. Aug 8 2022 300pm Editorial Note. Web 1099 or your own Corporation vs.

Web Use this tool to. When it comes to differences between Form W-2 vs Form 1099 it is important to note that the latter form is used for payments to. Everything you need to know Brynne Conroy Alana Rudder Alana Rudder Verified by an expert Verified by an expert means that this article.

Web Wondering what is the tax rate for 1099 income for 2022. Web The IRS requires self-employed taxpayers to pay income tax on all of their net profit and self-employment tax on net earnings of 400 or more. Taxpayers may need to consider estimated or additional tax payments due to non-wage income from.

The main difference is that W-2 workers get taxes withheld from their paychecks automatically as mentioned above. Expect to owe around in taxes of your income Tax Breakdown. Web November 28 2020 Q.

Base Salary year. Web Business W2 vs. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an.

Select your home state Each state has its own income tax rules. For example a W-2.

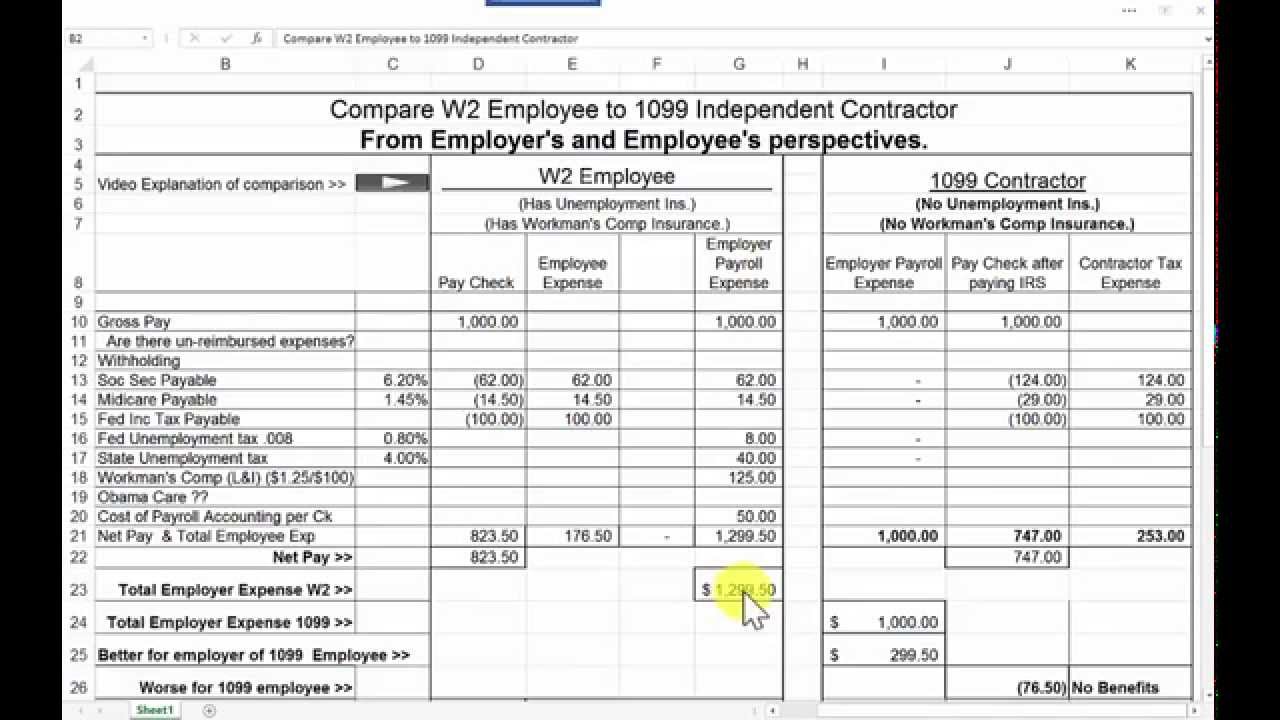

11 B Comparison Of W2 Employee To 1099 Independent Contractor13 Min Youtube

1099 Vs W 2 Pay Calculator

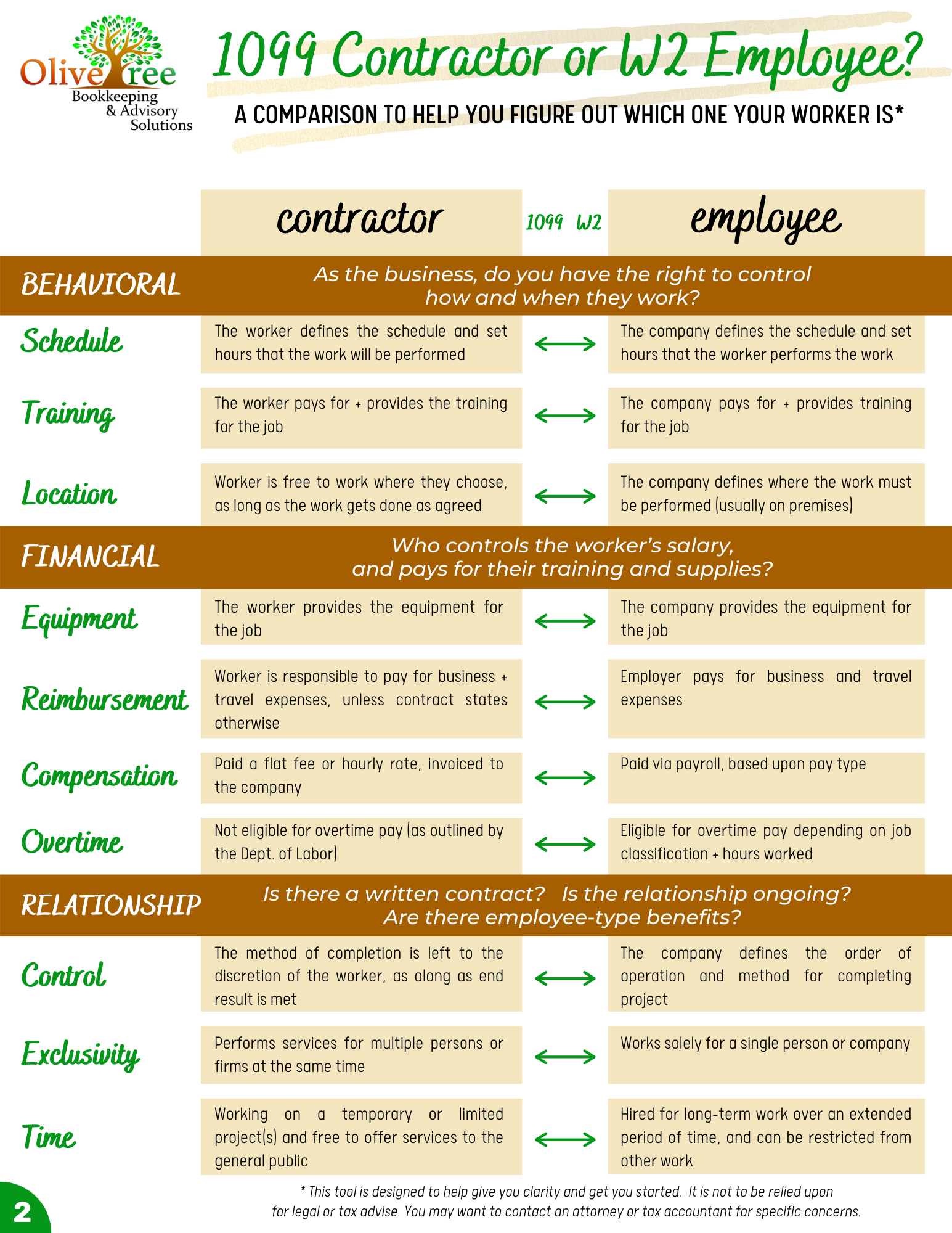

Lead Magnet Template For Bookkeepers 1099 Vs W2

1099 Tax Calculator How Much To Set Aside

:max_bytes(150000):strip_icc()/Screenshot2023-11-14at11.01.25AM-d5be418f3da3445ea7eaa624832cd6d0.png)

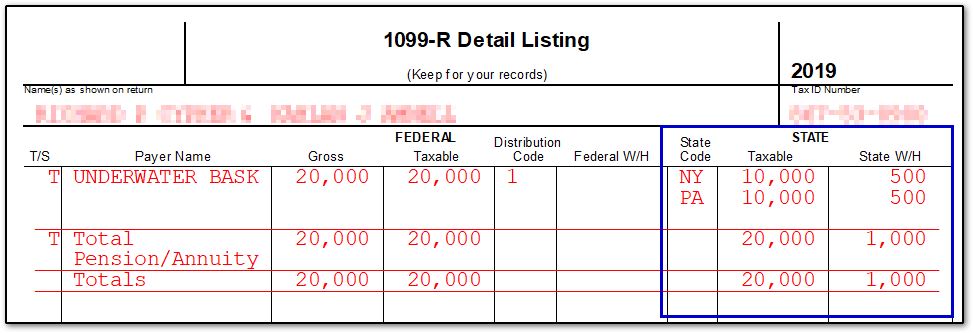

Form 1099 B Proceeds From Broker And Barter Exchange Transactions

Independent Contractor Vs Employee 1099 Vs W2 In Podiatry Student Doctor Network

Independent Contractor Taxes The 2024 Guide

What Is The Difference Between A W 2 And 1099 Aps Payroll

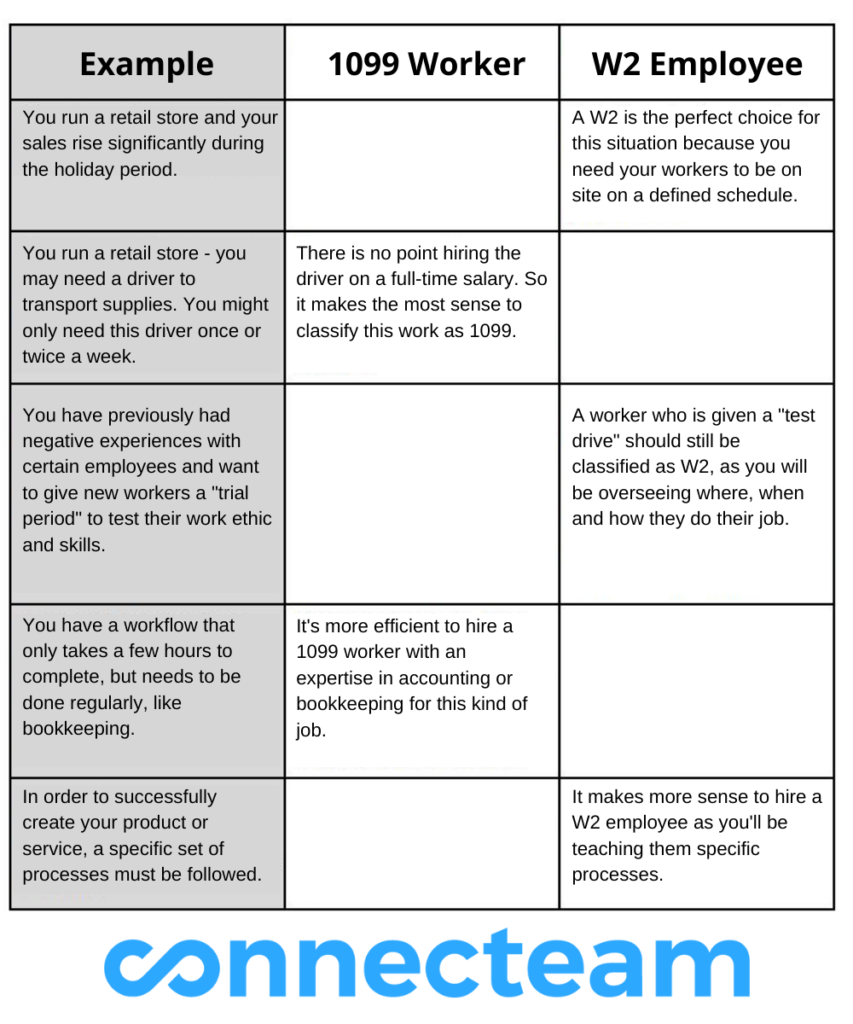

1099 Vs W2 Employee How Are They Different

W2 Vs 1099 Workers A Cost Comparison Got1099

Your 2020 Guide To Tax Deductions The Motley Fool

The Differences Between 1099 Vs W 2 Employees Connecteam

The Differences Between 1099 Vs W 2 Employees Connecteam

![]()

1099 Vs W2 Calculator To Estimate Your Tax Difference

1099 Vs W 2 Pay Calculator

![]()

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Forms W 2 And 1099 In View And Sets